Fraud Resources

American consumers reported $10 billion in fraud losses to the FTC in 2023.* Here are ways to help protect yourself from being scammed.

What can we help you find today?

Manage your finances wherever, whenever. Use our mobile banking app to check balances, pay bills and more.

Fraud Resources

American consumers reported $10 billion in fraud losses to the FTC in 2023.* Here are ways to help protect yourself from being scammed.

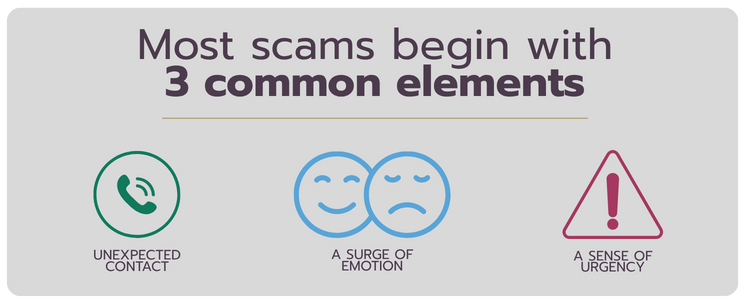

If someone is trying to get you to do something that you were not expecting and making you fearful if you don't act now, take a minute to STOP, LOOK and THINK.

Scammers are looking to play on your emotions to get you to act before you have time to think, because once you take a minute to think through what is going on, you are less likely to do what they are asking you to do.

If someone has reached out to you and you were not expecting it, discontinue contact with the person. Call the published phone number on the known website or listing of that company to verify what the person is asking you. Most likely, it is a scam.

We offer tools to help you manage your accounts and help prevent fraud.

There are alerts and card controls you can set up to keep you informed of what's going on with your accounts.

>> LEARN MORE to better protect yourself today!

Federal Fraud Resources

Don’t be an online victim. Visit the FDIC’s Consumer Assistance & Information page to stay informed about the latest scams and fraud.

Safeguard your identity. Visit the Federal Trade Commission’s Privacy, Identity & Online Security page for tips to protect your information and identity.

To report a suspicious email that uses our name or logo, forward it to us immediately at onlinebanking@heritagebankandtrust.com.

To report suspicious activity on your Heritage Bank & Trust account, contact us during business hours at (931) 388-1970.

*FTC News, February 9, 2024

Romance Scams

Has an online love interest asked you for money? That's a scam.

Online dating scams are on the rise. These scams were the costliest reported scam to the FTC in 2021, with a total reported loss of $547 MILLION in a single year.

Learn the signs of this scam and how to respond to protect your money.

Scholarship and Student Loan Fraud

College costs are rising. Looking for a loan? You're not alone. Be wary of the information you share, and where.

Protect yourself!

Elder Financial Abuse

The key to spotting financial abuse is to look for changes in a person's established financial patterns.

Check Scams

The United States Postal Inspection Service recovers more than $1 BILLION in fraudulent checks & money orders each year. If you mailed a check that was paid, but the recipient never received it, criminals may have stolen it.

Learn more about check washing and check theft scams to help keep your money $afe.

Protect Yourself and Your Money

Protect your personal information and financial assets.

Be prepared to avoid common financial scams.

Are you a business?

Our Treasury Management Solutions have a suite of services to help protect you and your business from potential scams and fraud.

Report Disputes or Fraud

How to Report a Lost/Stolen Debit Card or Fraudulent Charges

During normal business hours, call (931) 388-1970.

After-hours, call (833) 311-0067 for Mastercard® EMV Debit Cards

How to Report a Lost/Stolen Credit Card of Fraudulent Charges

Within the U.S.: 1-800-883-0131

Outside the U.S.: 1-813-868-2891

You put your customers first, and so do we. Our Treasury Management Solutions simplify everything from paying employees or vendors, receiving payments and depositing checks to managing fraud.

Make smart, secure money moves – online or on the go – with these tips on safeguarding your financial health.